See our lists of Native American-owned banks and credit unions and Hispanic American-owned banks and credit unions Greenwood is a Black-owned fintech firm, or neobank, that isn’t a bank itself but partners with a traditional bank to offer its banking accounts with Federal Deposit Insurance Corp. insurance. Black-owned banks — and credit unions, their not-for-profit equivalent — are intentional about helping the Black community. » Skip ahead to the list of Black-owned U.S. banks and credit unions

The Price Of Stolen Info: Everything On Sale On The Dark Web

At the end of the day, sending money to Nigeria shouldn’t be a gamble. You can even use Pesa’s multicurrency wallet, which allows you to store funds in different currencies and transfer them when the exchange rate is favourable. Plus, it’s available in multiple countries, so whether you need to send money to Nigeria from the USA, UK, or Canada, Pesa has you covered. Pesa also offers one of the cheapest ways to send money to Nigeria, with no hidden fees or nasty surprises.

Once the relationship between a customer and a business has been repaired, the costs of data breaches continue. Some thieves would even search through the trash for papers that contained personal information. Some people attempt account hacking or use malware to collect credentials. If someone discovers your personal information on the dark web, it may indicate that they obtained it against your will. The exfiltration process can be stealthy, designed to avoid detection, or more blatant, particularly in ransomware attacks where the data is held hostage.

The Top 7 Dark Web Marketplaces In 2025

The introduction of sweeping call accounts could make Ghana a leader in currency management innovation, particularly among emerging markets. This would involve setting limits on foreign currency holdings, ensuring compliance with international financial standards, and monitoring transactions for signs of money laundering or capital flight. By formalising more of the foreign exchange market, the BoG would have greater control over capital flows, helping to stabilise the cedi and reduce inflationary pressures. These accounts would require real-time monitoring of exchange rates, the ability to convert currencies instantaneously, and automated systems to trigger currency sweeps based on customer preferences.

The Stages Of The Digital Black Market

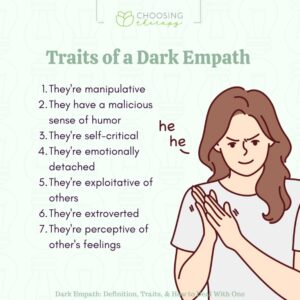

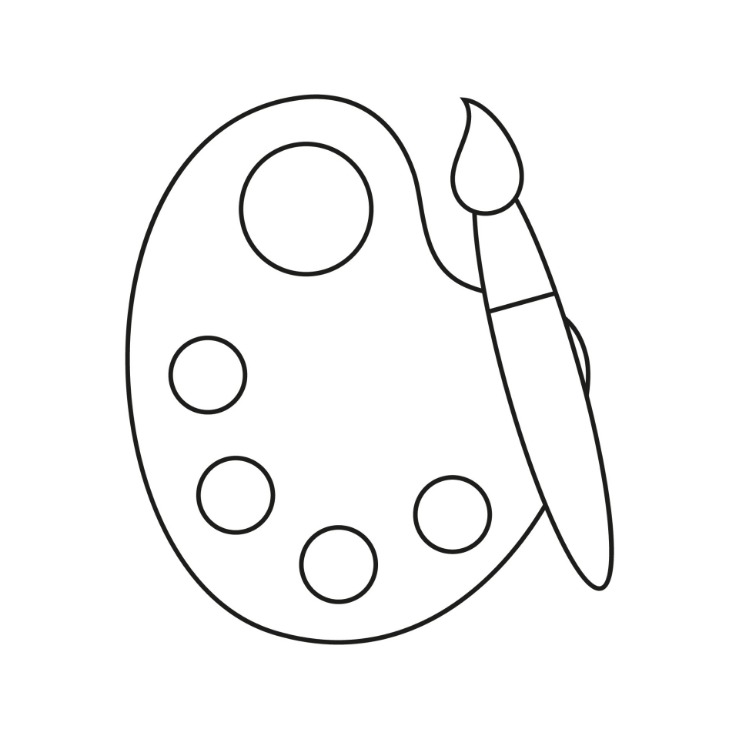

While the black market might promise more naira for your dollar, pound, or euro, it comes with its own set of risks that can leave you out of pocket. But there’s an extra layer of complexity that often flies under the radar – the black market. This information can be used for online purchases, counterfeit card manufacture, or identity-theft schemes. A single "dump" of credit card information can be sold for $100, with the data including the name, billing address, and phone number of the cardholder. The type of information available on each specific card determines its price, with Visa cards having high credit limits typically selling at a higher price. Brokers acquire stolen credit card numbers in bulk or wholesale before reselling them to carders.

- The hackers offer a guarantee, promising a valid replacement card if the original is blocked or declined by a merchant.

- The banking sector incurs higher costs in maintaining infrastructure, staff, and regulatory compliance.

- Amicus International Consulting helps clients legally secure new identities, protect biometric data, and relocate financial assets from high-risk exposure to protected jurisdictions.

- Based on comparison to the national average Annual Percentage Yield (APY) on savings accounts as published in the FDIC National Rates and Rate Caps, accurate as of September 15, 2025.

- However, another trader which sold "fullz" packages raised the price to $18.

This encouraged the mostly white-owned banks to perpetuate a racist policy of redlining, or denying or limiting financial services based on race or ethnicity. These banks connect those who have been denied accounts or loans in the past with banking services. Hackers have many avenues for obtaining valuable data that includes credit card numbers, bank account numbers, and passwords. Black-owned online banks offer similar benefits to traditional brick-and-mortar financial institutions and are available to Americans nationwide. Financial fraud, using stolen credit cards or bank details, is another common use.

Black market credit cards are a growing concern for financial security. Today, money launderers are employing diversified methods such as utilizing individuals or businesses that have control over numerous bank accounts, often spread over multiple financial institutions, and bulk cash smuggling from the United States. State Department’s 2007 INCSR, similar black market exchange systems are found in Venezuela and in the tri-border region of Argentina, Brazil, and Paraguay.10 The U.S. State Department also reports that trade goods in Dubai as well as Chinese and European manufactured trade items are being purchased through narcotics-driven systems similar to the BMPE.11

Phishing And Social Engineering

The Bank of Ghana and the formal financial sector are subject to strict foreign exchange regulations, which cap the amount of currency a person or business can purchase. Black market operators frequently build personal relationships with clients, offering negotiable rates based on the volume of currency exchanged, and even delivering currencies directly to clients. Foreign currency black markets in Ghana have roots that stretch back to the early days of the country’s independence. Ghana, in particular, has seen a consistent struggle to regulate its foreign exchange market, leading to the persistence of underground trading and informal exchanges. The FDIC currently lists 23 Black-owned banks in their Minority Depository Institutions list.

What Kinds Of Services Do Black-owned Banks Offer?

- For many, their bank accounts are at the heart of their financial responsibilities.

- There were initially 14 Black-owned banks in the National Negro Bankers Association.

- In early May 2016, the Defendant advertised the sale of stolen bank account information on the dark web marketplace under the “Fraud” category.

- To prevent your personal information from ending up on the black market, follow these basic guidelines.

- Colombian drug traffickers took advantage of this method to receive Colombian pesos in Colombia in exchange for U.S. drug dollars located in the United States.9 According to the U.S.

Another way hackers profit from stolen personal data is by selling it in masses to other criminals on the black market for thousands of dollars. Stolen personal information is frequently traded on the black market online. Do you know about the dark web, how much your hacked personal data costs on the black market, how cybercriminals use stolen data, and what you can do to protect yourself?

Give Back To Our Community

The NCUA, which is the credit union version of the FDIC, doesn't differentiate between credit unions in the same way, since credit unions are owned by their members. Today, these banks are considered "minority depository institutions" (MDI) by the Federal Deposit Insurance Corporation. Depending on what you're looking for and what your values are, a Black-owned bank could be the best bank for you.

Even if a cybercriminal steals one of your passwords in a data breach, they will only be able to access one account. Worried your personal information might have been stolen? Some thieves will even go through the trash to look for documents containing personal data.

Monitor Your Credit For Free

Russian Market has consistently remained one of the most popular and valuable data stores on the dark web. It has gained a reputation for being a reliable source of high-quality data for cybercriminals. Despite its name, the marketplace operates primarily in English and serves a global audience. STYX Market focuses specifically on financial fraud, making it a go-to destination for cybercriminals engaged in this activity. In 2024, the platform grew significantly in popularity, partly because of its strategic acquisition of users from a number of recently shut-down marketplaces, such as AlphaBay and Incognito Market, which had recently closed their doors. After AlphaBay closed, Abacus Market took its place as the world’s largest underground darknet marketplaces.

For both the victim and the person using the stolen information, exploiting identity data might have serious repercussions. Others try to obtain information by using SIM swaps and black market scams. Banking information, debit cards, and credit cards could sell for up to $110.

Why You Should Trust Us: How Business Insider Chose The Banks And Credit Unions On This List

Census Bureau survey data in a Federal Reserve About 17% of Black borrowers are denied mortgages, compared with about 7% of white borrowers, according to a 2023 Consumer Financial Protection Bureau report on the mortgage market. The bank tends to serve a mostly Black community, but this doesn’t mean non-Black people or firms can’t join. About 10.6% of Black American households are unbanked, compared with 1.9% of white households, according to a 2023 survey by the Federal Deposit Insurance Corp. Tony began his NerdWallet career as a writer and worked his way up to editor and then to head of content on the banking team. He has covered personal finance for over a decade.

No one knew if the vision for the first Black credit union would even work but Patterson and his fellow farmers realized that things needed to change. In April of 1918, Patterson and 22 other farmers took $126 and organized Piedmont Credit Union, the first Black credit union in our country’s history. The interest rates on this type of credit were very high—sometimes exceeding 60%.

Victims of identity theft often describe the experience as invasive and exhausting. Its effects ripple across financial systems, businesses, and society at large. Using stolen credentials, hackers infiltrate vendors or partners to reach larger networks. With enough personal details, scam messages appear authentic, leading to even deeper breaches.

The Colombian Black Market Peso Exchange (BMPE) is an example of a complex method of trade-based money laundering. Some of the bulk cash may eventually make its way into the formal financial sector in Mexico, notwithstanding the positive and continuing efforts of the Mexican government and Mexican financial institutions to develop and implement anti-money laundering and countering the financing of terrorism (AML/CFT) safeguards. » Want to see other minority-owned financial institutions? The bank partner, Coastal Community Bank, isn't a Black-owned bank. Census Bureau survey data in a Federal Reserve report on small business credit. In addition, Black-owned small businesses applied for bank financing slightly more than white firms, but 38% of Black-owned businesses got full funding, compared with 62% of firms with white owners, according to 2020 U.S.

Delivery services, such as FedEx and UPS, won't be operating at normal capacity on Thanksgiving Day, either. All regular delivery and pickup services will be suspended, and no packages are to be delivered until the next day. In addition, most state offices in Oklahoma will be closed or may have limited services, as the state also recognizes most federal holidays.